Health insurance is one of the most significant bills most families face each year, yet many leave money on the table simply because they don’t read the fine print. From hidden perks that cut costs to the most innovative ways to use every dollar you pay, there are chances most people never notice.

Whether your plan comes from work, a healthcare marketplace, or a private company, these eight straightforward hacks can help you become a more informed and confident consumer.

So, grab your card and a cup of coffee, because it’s time to put your coverage to work for you.

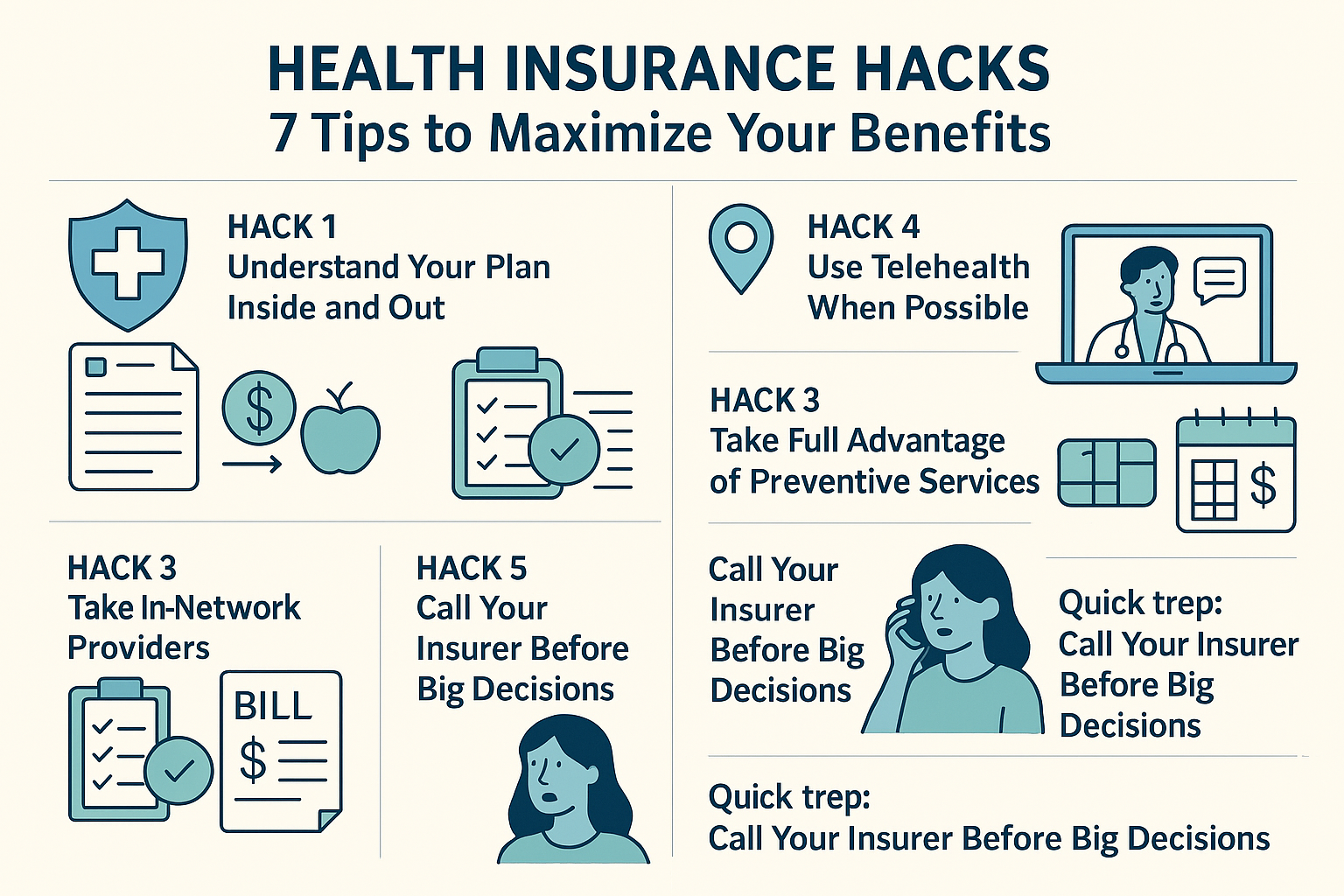

Hack #1: Understand Your Plan Inside and Out

The very first move-and the one that makes all the others worthwhile learning exactly what your policy says it covers and what it ignores.

Key terms to know are Premium, the monthly bill for staying insured; Deductible, the chunk you pay out-of-pocket before the plan begins to help; Copay, a flat fee due when you walk in the door; Coinsurance, the percentage that comes from your pocket after the deductible is cleared; and Out-of-pocket maximum, the ceiling beyond which the plan pays 100 percent for the rest of the year.

Why it matters is simple: without this map, you could skip free preventive visits, pay too much for an X-ray, or end up with a surprise bill because that nice hospital is out of network.

Quick tip: Download your insurer’s app or access their online portal and save a copy of your Summary of Benefits, so you can easily find it.

Hack #2: Use In-Network Providers

Insurance policies typically maintain a list of doctors, clinics, and hospitals that accept discounted rates. Seeking care from out-of-network practitioners might cost between two and five times more, and could also result in no coverage.

What to do:

- Utilize your insurer’s online directory to locate in-network providers.

- Verify your doctor’s in-network status before scheduling an appointment.

- Also, inquire whether the laboratories or imaging centers your physician uses are in-network.

Pro tip: For any planned surgeries or procedures, ask your physician if all the participating personnel (anaesthesiologists, labs, etc.) are in-network.

Hack #3: Take Full Advantage of Preventive Services

Most preventive services are available under the Affordable Care Act at no cost and before the deductible is met.

Examples include:

- Annual physicals

- Mammograms and pap smears

- Colonoscopies

- Immunizations like flu shots and COVID-19

- Screening for diabetes, blood pressure, and cholesterol

Why it matters:

Issues can be addressed efficiently and early through the preventive approach.

Pro tip: Meeting your deductible is not a requirement to access these services.

Hack #4: Use Telehealth When Possible

Telehealth visits are not only convenient but often significantly cheaper than in-person appointments.

Advantages include –

- Access to specialists outside your area

- Lower copays or deductibles

- No waiting room or commute

Telehealth is perfect for:

- Medication refills

- Cold/flu symptoms

- Mental health therapy

- Skin issues

Pro tip: Some health insurance plans provide free virtual visits or partnerships with platforms like MDLIVE or Teladoc.

Hack #5: Time Major Expenses Around Your Deductible

If an expensive procedure or surgery is on the horizon, make sure to consider your timing.

Strategy:

- To maximize insurance coverage, consider accessing care that helps meet your deductible benefit late in the year.

- If benefits have not been fully utilized and maximum coverage can be obtained early in the year, schedule the procedure early in the year.

Example:

If your deductible amount is USD 2,000, and you have already spent USD 1,800, a USD 10,000 surgery will cost you around USD 200 instead of thousands of dollars if you wait until next year.

Hack #6: Track Your Claims and Bills

Mistakes in medical billing, as you may be surprised to learn, are pretty standard. Always cross-check bills from your provider against your Explanation of Benefits (EOB) document to ensure accuracy.

Look out for:

- Duplicate charges.

- Services you were not provided.

- Charges from out-of-network providers that should not have been billed.

- Preventive services should have no cost.

What to do:

- For confusing charges, insurance providers are usually the first point of call to be made for clarification.

- In case of persistent errors, reach out to your provider’s billing office.

- Contest and request detailed billing to negotiate when necessary.

Pro tip: Leveraging health expense tracker apps or simple spreadsheets can help manage medical expenses over time, ensuring that payments made are not excessive.

Hack #7: Call Your Insurer Before Big Decisions

If you are covered for something and are unsure, don’t guess—ask.

Insurance companies usually have 24/7 hotlines where you can:

- Confirm if a doctor or treatment is covered

- Check your deductible and out-of-pocket status

- Get prior authorizations for surgeries or medications

- Ask for in-network alternatives to high-cost prescriptions

Why it matters:

One phone call could save you hundreds—or even thousands—by avoiding surprise bills.

Pro Tip: Always get a reference number for your call, in case you need to prove what was discussed.

Bonus Tip: Review and Update Your Plan Annually

Don’t auto-renew a policy. Your health requirements and insurance options can change every year.

During Open Enrolment:

- Compare plans based on premium vs deductible trade-offs

- Make sure your preferred providers are still in-network

- Check for added benefits like mental health, maternity, or specialty services

- Update income info to check eligibility for subsidies or better pricing

Pro Tip: Utilize free comparison tools or consult a certified health insurance navigator for expert guidance.

Quick Recap: Health Insurance Hacks That Save

| Hack | Why it works |

| Know your insurance plan terms. | Avoid any expensive surprises. |

| Use in-network providers | Get the cheap prices. |

| Take advantage of preventive care. | Free services = Long life savings |

| Maximize your HSA and FSA | Tax-free healthcare spending |

| Use telehealth, when possible, for you. | Cost savings + Super convenient |

| Schedule around your deductible amount. | Pay less money for big procedures. |

| Track your expenses and EOBs | Find errors & overcharges. |

| Always call before big decisions. | Confirm insurance plan coverage ahead of time. |

Frequently Asked Questions (FAQs)

Q1. What’s better: a low deductible or a low premium?

It comes down to your medical habits. When injuries, meds, or check-ups pile up, a low deductible cuts your out-of-pocket costs sharply. However, if you rarely visit a doctor, a higher deductible with lower monthly bills can help keep costs down.

Q2. Can I use FSA funds to cover expenses for my spouse or children?

Absolutely. Any eligible expense for you, your spouse, or your dependents counts, even if they aren’t on your plan, and the money is spent the same way.

Q3. What if my insurance denies a claim?

First, don’t stress; you can appeal. Insurers must give you a clear path to challenge denials, so gather files, write the letter, and add any missing proof.

Q4. How do I know if a service is preventive?

Refer to your plan’s Summary of Benefits or contact your provider directly for more information. Under the Affordable Care Act, a yardstick list of free preventive services is always there.

Q5. Can I negotiate medical bills even with insurance?

Yes, you can, and patients often forget that. Before a big bill arrives, especially for non-emergency care, ask about cash discounts, easy payment plans, or charity relief.

Final Thoughts: Take Control of Your Coverage

Health insurance is often a maze of jargon and fine print, yet it doesn’t have to drain your budget every month. By keeping a clear plan, you can maximize the value of each premium, avoid unexpected bills, and access the care your family deserves, all while staying informed about the costs.

The trick is simple: pay attention, speak up, and claim every perk you’re entitled to. Used effectively, insurance becomes more than a safety net; it turns into a practical ally in living healthier and managing financial worries.