No matter if you own a house or rent an apartment, you need some form of insurance to guard against losses that may arise or even against being sued for some form of liability.

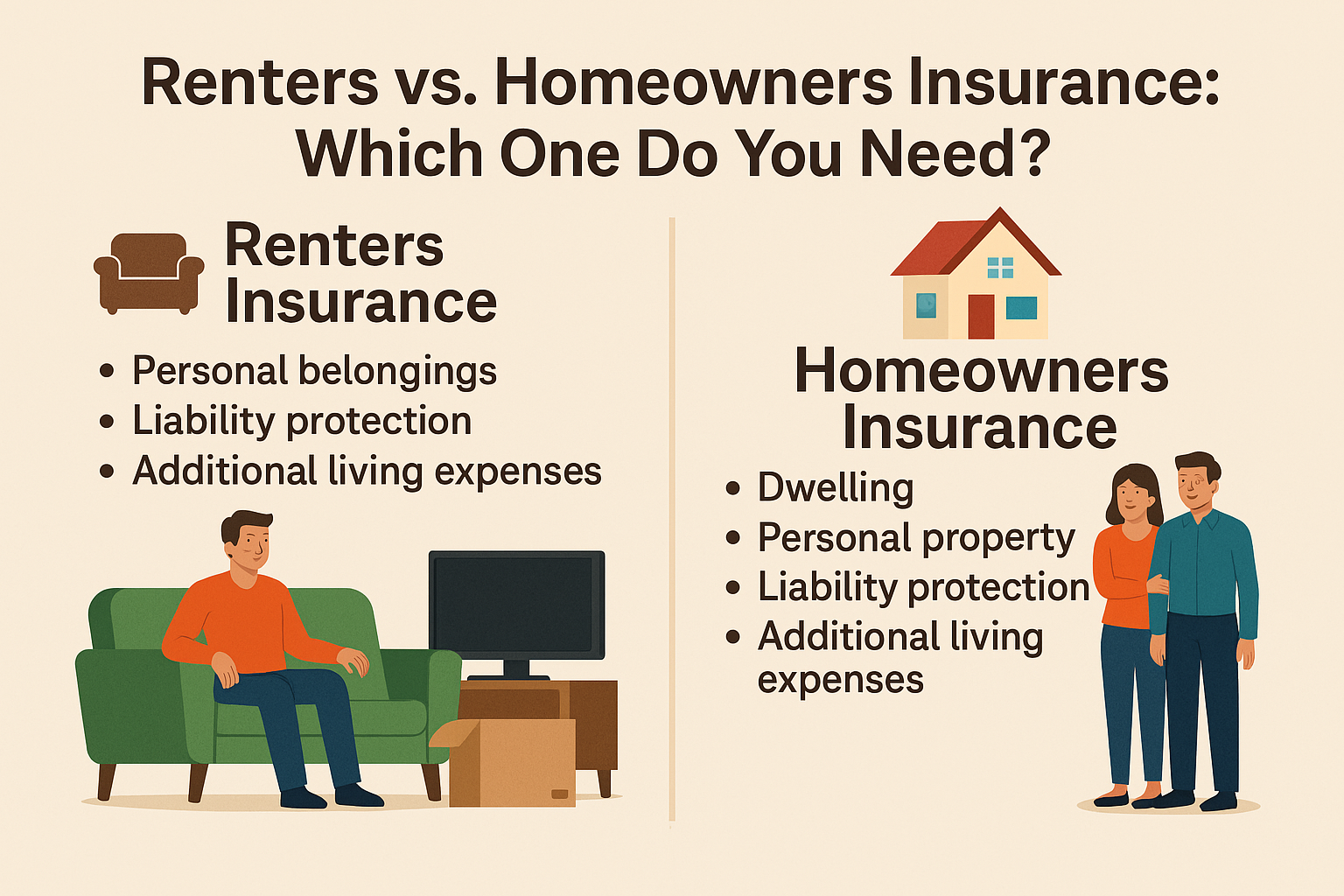

With Homeowners’ insurance and Renters’ insurance, two distinct types of insurance available, many users are perplexed as to what they need, what their policies cover, and how specifically they differ.

Are you still wondering which policy best fits your needs and which option offers the best value for your money?

If yes, we have you covered. In this article, we will highlight the differences between Renters’ and Homeowners’ insurance, examine their coverage differences and costs, discuss the benefits and disadvantages of both, and most importantly, help you reach a well-informed decision.

What Is Homeowners Insurance?

Homeowners’ insurance is specifically designed for individuals who own their property and provides comprehensive coverage tailored to their needs.

It contains:

- The structure of your home (walls, roof, floors, etc.)

- Personal property (furniture, electronics, clothing, etc.)

- Liability protection (if someone is injured on your property)

- Additional living expenses (if your home is uninhabitable)

Most mortgage lenders need an insurance plan as part of the loan contract.

What Is Renters’ Insurance?

Renters’ insurance is tailored for individuals who rent a house, apartment, condo, or even a room. Since they don’t own the building, it will not cover the additional costs of any insurance on the structure, but it offers important protections.

It contains:

- Additional living expenses

- Liability protection

- Personal belongings

Renters’ insurance plan is not generally required by law, but several property holders now require it as a condition of the lease.

Side-by-Side Comparison

| Feature | Homeowners Insurance | Renters Insurance |

| Covers Personal property | Yes | Yes |

| Covers building Structure | Yes | No |

| Additional living expense | Yes | Yes |

| Liability Coverage | Yes | Yes |

| Required by the Landlord/lender | Often by lenders | Often by lenders |

| Average annual cost | $1200 to $2500 | $120 to $300 |

What’s Covered (And What’s Not)

- Fire, smoke, wind, hail, lightning.

- Theft and vandalism.

- Water damage (excluding floods).

- Falling objects.

- Personal liability (e.g., dog bites, slip-and-fall accidents).

Not covered: Floods, earthquakes, pest damage, general wear and tear. Additional policies or endorsements may be required.

Renters Insurance Covers:

- Theft or loss of personal belongings.

- Damage to belongings by fire, smoke, or water.

- Accidental damage to the property of others.

- Housing allowance for temporary accommodation if your rental is damaged.

Not covered: The building structure, floods, and earthquakes, or your roommate’s belongings, unless added by endorsement.

Personal Property Protection

Both Renters and Homeowners policies contain personal property protection; however, the amount needed is determined by the individual’s possessions.

Example:

- In the event of a fire in your apartment, Renters’ insurance would reimburse you for a couch, laptop, clothes, and television.

- In a house fire, Homeowners’ insurance would replace all those items, plus rebuild the house.

Pro Tip: Conducting a home inventory helps estimate the amount of coverage needed. Many misjudge and undervalue their belongings.

Liability Plan Coverage

Both types of insurance offer liability protection, which helps pay for:

- Medical expenses for injuries incurred during someone’s visit to your home

- Legal costs arising from any lawsuit against you

- Other people’s property damage that you unintentionally cause

Example: In the case of a dog biting a visitor or an overflowing bathtub flooding a lower apartment, liability insurance would cover the costs.

Additional Living Expenses (ALE)

For renters and Homeowners insurance, the coverage extends to:

- Hotels

- Temporary housing

- Meals and their transportation

Claimed under:

- Loss of Use

Additional Living Expenses (ALE)

If your home becomes unlivable due to fires or storms, ensure that your displacement duration extension policy limits are in place.

Cost Differences

Insurance type costs vary, but one other significant consideration is:

Average Annual Premiums:

- Homeowners insurance: 1,200to1,200to2,500 (varies by location, home value, and risk)

- Renters insurance: 120to120to300 (that’s just 10–10–25 per month!)

Why so cheap? Renters’ insurance doesn’t cover the building itself, which is the most expensive part to insure.

Why is Homeowners Insurance a good choice?

Insurance is something you should consider if you own a home. Investing in property typically costs hundreds of thousands of dollars, and even a minor mishap can result in substantial losses.

Advantages:

- Protects your home’s value and equity

- Covers personal property and liability

- Required by most mortgage lenders

- Offers peace of mind against disasters

Without it, you could be financially devastated by a single event like a fire, flood, or lawsuit.

Why Renters Need Insurance?

Many renters incorrectly assume their landlord’s insurance policy covers their personal belongings—it doesn’t. Your landlord’s policy only protects the structure itself.

Why do you need Renters’ insurance?

- Affordable protection for all your personal belongings

- Legal protection for accidents or damage

- Housing assistance if your unit becomes uninhabitable

- required by many landlords and property managers

Bonus: Policies may even cover belongings stolen from your car or while traveling.

Common Myths Debunked

“I don’t own anything of significance.”

You might be surprised. Adding up the replacement value of:

- Furniture

- Electronics

- Clothing

- Kitchen item

- Books, tools, shoes, and jewellery

Most Americans possess $20,000 to $ 50,000 worth of belongings without realizing they own these items.

“My landlord’s insurance provides coverage for me.

Not quite. It only pertains to the property itself. Any personal belongings would be your responsibility to insure.

“Renters’ insurance is expensive.”

Most plans cost less than $1 a day. You will spend more on drinks.

Add-Ons & Optional Coverages

Both renters’ and Homeowners’ insurance offer endorsements or riders for additional coverage.

Examples:

• Flood insurance (not included in standard policies)

• Earthquake insurance

• Identity theft coverage

• Home business protection

• Scheduled personal property (jewellery, art, instruments)

Talk to your agent to finalize a policy that is tailored to your specific needs.

Switching from Renters to Homeowners Insurance

If you are moving from renting to owning a home, then you need to update your policies.

Steps:

- Cancel your Renters policy after your Homeowners policy starts

- Transfer your home inventory and update your coverage

- Adjust limits to cover the structure, not just your belongings

Pro Tip: Purchase bundled auto and Homeowners insurance to save up to 25%.

Frequently Asked Questions (FAQs)

Q1. If my roommate has Renters’ insurance, do I still need it?

Yes. Each renter’s insurance policy is a separate entity. Every policyholder is only insured for the risks outlined in the policy issued to them; therefore, every roommate needs their own policy, unless they are added to each other’s.

Q2. Does either policy cover flood damage?

No. For both renters’ and Homeowners’ policies, flood damages are usually excluded. They require separate flood insurance, which can be purchased from FEMA or private companies.

Q3. Am I covered for my belongings if they are outside the home?

Yes, most policies cover a specific limit of theft or damage to belongings while traveling, such as a stolen laptop or suitcase.

Q4. What’s the difference between replacement cost and actual cash value?

- Replacement Cost covers the cost of replacing the item today.

- Actual Cash Value pays the depreciated value of the item.

Coverage based on Replacement cost is more beneficial, making it a better option, as it only costs marginally more.

Q5. How do I file a claim?

Your insurer’s contact number or application. Make sure you have:

- In-depth description of all damaged or stolen items

- Photographs, serial numbers, and receipts, if available

- Police or Fire Report, if applicable

Final Verdict: Which One Do You Need?

If You Own Your Home:

Homeowners’ insurance is needed not only because lenders mandate it, but also to safeguard one of your most treasured assets.

If You Rent:

Renters’ insurance is needed to shield your belongings, liability, and housing security. It’s incredibly affordable and frequently a requirement from landlords.

Regardless of where one resides, having insurance provides peace of mind.